ㅤ

We brought together senior leaders from some of the UK’s most renowned brands across switch-heavy industries at an exclusive roundtable hosted in partnership with the Data and Marketing Association (DMA) to discuss a pressing matter: the challenges of customer loyalty and what providers can do to combat the switching culture.

Stop the Switch: How Brands Keep Customers Connected is a joint industry report by MBA Group and the DMA covering why customers are disconnecting, the real financial cost of churn, and what the most effective retention strategies look like in practice.

Rather than basing the report solely on data and desk research, we wanted it to be informed by people working against these challenges day to day. The conversations were candid and honest, challenging each other’s assumptions and surfacing things that don’t always arise in formal research. Key quotes from the discussion are featured in the report, alongside analysis of over 1,700 data points from the DMA data bank including award-entered campaigns, survey responses and interviews.

ㅤ

If retention is on your agenda for 2026, download the report.

ㅤ

But first, here are the highlights from the roundtable.

ㅤ

The Damage of the Loyalty Penalty

Most people in the industry know the loyalty penalty exists. Rewarding new customers with better deals while existing ones quietly pay more has been a feature of utilities and telecoms pricing for years. What came through clearly in the room, though, was just how much damage this is doing to long-term trust, and how quickly it can end a relationship entirely.

“Finding out new customers are paying less than existing customers doesn’t just result in an ‘I’m not happy’ moment; it’s actually an ‘I’m never coming back’ type of moment — because the perception is: why is that person more valuable to you than me, when I’ve been with you for six years?”

– Ali Khan, Customer Analytics Advisor, Ex. WPP / Meta / Amazon

ㅤ

There’s a reason this point lands so hard. For a long-term customer, discovering they’re paying more than a new joiner feels like a direct message that their loyalty counts for nothing.

ㅤ

The Financial Case Against Churn

It’s well known that acquisition efforts costs businesses much more than retention does. But the leaders in the room wanted to go further and talk about how churn impacts a business over time.

“Every pound that you lose because of churn is almost two pounds you need to bring back in new business, just from a P&L perspective. Retention is absolutely the foundation of what we do.”

– Richard Robinson, General Manager, Insight by Confused.com

ㅤ

And the problem only gets harder the longer high churn continues.

“The bigger the churn gets, the bigger the true cost gets as well, because you essentially reduce your addressable market. There’s a confirmation bias that builds: ‘I tried them, I didn’t like them, I won’t go back.’ That voice is now much more visible than it was 10–15 years ago.”

– Michael Campbell, Marketing Director, So Energy

ㅤ

Reviews, social posts, conversations in group chats. A dissatisfied former customer has more reach now than ever. The cost of losing someone isn’t just the revenue line, it’s the conversations you’ll never see but that are absolutely happening behind your back.

ㅤ

Loyalty, or Inertia?

Probably the most honest thread running through the roundtable was that a lot of what brands call loyalty is actually inertia. Many customers who haven’t switched aren’t loyal in any meaningful sense, they just haven’t got round to it yet.

“We often see passive loyalty. Customers are loyal until something happens. It’s not an emotionally driven decision, it’s a condition-driven decision.”

– Richard Robinson, General Manager, Insight by Confused.com

ㅤ

The implication of this is uncomfortable but important. If customers are only staying because switching feels like hassle, then a single poor experience like a confusing bill, a price rise letter that lands badly, or a customer service call that goes nowhere, can be the thing that finally makes them switch. Years of adequate service won’t protect you from one bad moment if you haven’t built any real connection in between.

Which is why the leaders who are thinking about this well are focusing on the relationship before the ultimatum, not after it.

“If you understand your customers and what their next big investments are likely to be, you can start to nurture and bring them on that journey so that when the time comes for that big decision-making investment, they do it with you.”

– Michael Campbell, Marketing Director, So Energy

ㅤ

The Market Has Changed

Switching friction, one of the few structural reasons customers stayed put, has been deliberately removed with the introduction of One Touch Switch. For leaders already operating in an intensely competitive market, that change has raised the stakes even more.

“The telecoms sector was already an incredibly competitive one, with a wide range of products and deals available to the ultimate benefit of UK consumers. Now, following the introduction of One Touch Switch in our sector, it’s more important than ever for providers to adapt to keep meeting customers’ expectations.”

– Hannah Brown, Head of Customer Communications, Virgin Media O2

ㅤ

And in that environment, the temptation to compete on promotional offers is understandable, but the evidence suggests it doesn’t always work.

“When you’re trying to bring down churn, matching acquisition offers barely makes a dent. What matters is delivering on basic needs. Network quality, speeds, being able to call when you need to, access to data and transparency.”

– Sharad Malik, Customer Engagement and Loyalty, Lyca Mobile

ㅤ

Getting the fundamentals right before layering on loyalty programmes sounds obvious. In practice, plenty of businesses are still doing it the other way around.

ㅤ

Common Themes From the Room

- Fairness keeps coming back. Across almost every topic, the word that kept surfacing was fairness. Customers aren’t just comparing tariffs anymore, they’re forming a view about whether a provider is treating them reasonably. That perception is increasingly what drives the decision to stay or go.

- Demographic segmentation has had its day. The shift toward behavioural data was something multiple leaders raised, and Ali Khan put it most directly:

ㅤ

“Customer segmentation used to be done quite traditionally based on age and socio-economic factors. What we’ve seen in recent times is it’s gone very behavioural, based on what you’re doing and how you’re behaving. An 18-year-old might be behaving exactly the same as someone in the 45 age group in terms of tech usage, so putting them in separate segments makes absolutely no sense. Now they’ll get grouped together based on behaviour, spending patterns, and usage. We have some segments that have nothing to do with spend at all – they’re based purely on interest.”

– Ali Khan, Customer Analytics Advisor, Ex. WPP / Meta / Amazon

ㅤ

“Harnessing customer data gives brands a competitive edge, informing decisions from strategic direction through to campaign execution and measurement.”

– Ian Gibbs, Insight and Planning Director, DMA

ㅤ

- Retention belongs to the whole business. Marketing can’t solve churn on its own. When customer-facing teams are misaligned, when the brand promises something operations can’t deliver, or when complaints are handled in isolation from everything else, customers feel the disconnect and it shows up in their decision to leave.

ㅤ

Brand Substance Matters as Much as Brand Personality

A lot of the conversation, understandably, was about data, price and service. But one of the more interesting threads was about what brand identity actually does for retention, and where it falls short on its own.

“The major players have created strong brand identities from the beginning, different colours, distinct personalities, and customers became loyal to their choice. That mind share and consistent presence builds loyalty. But brands also need substance behind the personality: environmental commitments, ethical practices, what they truly stand for. Both layers matter.”

– Louise Winch, Head of Customer Communications and Marketing, TalkTalk

ㅤ

In a market where tariffs can look almost identical, a strong brand genuinely does help. But customers are increasingly good at spotting the gap between what a brand says it stands for and how it actually behaves. When that gap is visible, it becomes another reason to leave.

ㅤ

What It Adds Up To

Taken together, the roundtable pointed to churn that is largely preventable, driven by broken trust, passive loyalty that was never properly nurtured, and a persistent tendency to prioritise new customers over existing ones.

None of this is unfixable. But it does require businesses to take retention seriously as a strategic priority, with the data, the internal alignment, and the customer understanding to back it up, rather than treating it as something to address once acquisition starts to slow down.

ㅤ

This article draws on exclusive roundtable discussions hosted in partnership with the DMA, featuring senior leaders from across utilities, telecoms, and insurance.

ㅤ

For the full analysis, including case studies from O2, EE, Power NI, SMARTY and more, download Stop the Switch: How Brands Keep Customers Connected:

ㅤ

How the youngest consumer generation is shaping markets, media, and meaning

We’ve become fluent in the language of generational marketing, understanding Boomers, Gen X, Millennials, and Gen Z in terms of behaviours, expectations, and the best ways organisations can connect with them.

But as we settle into 2026, a new cohort is moving into influence. Generation Alpha, born between 2010 and 2024, are not only entering the teen years but beginning to make economic and cultural impact. In 2026, the oldest Gen Alphas will turn 16. They’re opening bank accounts, making purchases, influencing family spending, and already shaping entire categories of consumption. But you’d be wrong to assume they’re simply “mini-Gen Zs”. Their formative years have been shaped by a unique mix of digital immersion, post-pandemic experiences and hyper-connected social environments that make them unique to any other cohort.

In this article, we explore how Gen Alpha differs from other generations, unpack what the data says about their behaviours and expectations, and highlight what marketers and communicators should know to connect with them meaningfully and strategically.

ㅤ

Navigating generational flux?

Our whitepaper, Shift Got Real, explores the evolving expectations of UK consumers from Baby Boomers to Gen Z, with actionable strategies to connect with them meaningfully.

ㅤ

Gen Alpha: A Distinct Consumer Cohort

Gen Alpha’s consumer footprint is already noticeable. In the U.S. alone, children as young as 8–14 are reported to influence around 42% of total household spending, equating to over $100 billion in direct spending power, [DKC Analytics (2025)] mostly through decisions about food, entertainment and digital media subscriptions, and 91% are actively earning money through chores, online activity, or other small jobs.

In the UK, Attest research finds that 94% of teens aged 15–16 have some form of savings, with 51% holding more than £1,000 and 11% sitting on over £10,000, including funds in trust. Nearly half hold traditional bank accounts, and 37% use digital banking products. This level of financial activity at relatively young ages proves how quickly this generation is becoming economically sophisticated, and why businesses need to adapt to them.

ㅤ

Redefining Digital Balance

Gen Alpha’s media and consumption habits reflect a generation raised in a world where screens are the primary interface with information, entertainment, and social life. In the UK, 93% of Gen Alpha teens engage in gaming daily, and 39% spend over three hours a day gaming, surpassing TV and audio consumption, a significant shift from previous youth cohorts. [Ofcom. 2024]

Across markets, research shows that gaming isn’t just passive entertainment. For Gen Alpha, gaming spaces are social hubs where friendships form, group chats start, and even early dating happens. Mario Party-style multiplayer experiences have seen an engagement rise of around 11% since 2021, blurring the line between digital and physical social activity. [Newzoo, 2023]

But Gen Alpha don’t always live online. Even as they are “digital first,” there’s evidence that this generation is recalibrating its relationship with screens. Post-pandemic tracking shows a gentle decline in overall device time as many teens take deliberate breaks, with 40% of 12–15-year-olds saying they take breaks from their devices, and a rise in offline behaviours like board gaming and physical toys. [Ofcom. 2024]

This balanced digital-offline mosaic matters because it challenges the stereotype that Gen Alpha is tech-addicted; instead, they’re navigating digital life with nuance and, in many cases, more parental guidance than ever before.

ㅤ

Beyond the Screen: In-Person and Experiential Preferences

Despite their deep engagement with technology, Gen Alpha still values real-world experiences. Research from retail and travel sectors indicates a strong preference for in-store shopping experiences, driven by hands-on exploration and social interaction with family, particularly in beauty and lifestyle categories.

This preference extends to broader family decisions too. A Hilton travel survey found that 70% of parents with Gen Alpha kids let them significantly influence travel choices, from destinations to dining spots, reflecting not just consumption power but decision-making clout.

ㅤ

How Gen Alpha Differs from Gen Z

It’s natural to assume that Gen Alpha will simply follow Gen Z, but emerging data suggests important contrasts:

- Media habits: Whereas Gen Z grew up with social media platforms like TikTok and Instagram as identity stages, Gen Alpha is more likely to spend sustained time in interactive gaming worlds where play, communication and consumption converge.

- Social media usage: Gen Alpha tends to use social media more for staying in touch with friends than for self-expression and performance.

- Educational preferences: Interactive, gamified learning tools and AI-enhanced educational content are more appealing to Gen Alpha than traditional textbooks.

- Brand interaction: They expect hyper-personalised, immersive brand experiences rather than the relatable, “authentic” messaging prized by Gen Z.

These differences stem partly from their upbringing: Gen Alpha is the first cohort to have had widespread access to tablets, AI tools and cross-device connectivity from early childhood.

ㅤ

What This Means for Marketers

For communicators and brands, Gen Alpha presents both challenges and opportunities:

- Think beyond parents: While many marketing strategies historically “target kids through parents,” Gen Alpha’s financial agency and influence means brands must address the generation directly where appropriate, especially in digital spaces like gaming and interactive content hubs.

- Leverage immersive experiences: Static ads and traditional social content may fall flat; interactive branded experiences, whether in-game, in-app, or in community platforms, are more likely to resonate.

- Balance digital with real-world value: Positioning products as enablers of offline experiences and social connection will be vital, especially as this generation shows interest in exploration and breaks from screens.

ㅤ

Preparing for Impact: Gen Alpha’s Influence

As the oldest Gen Alphas enter mid-teens and begin forging adult consumer behaviours, their influence on spending, culture and brand expectations will only grow. This is a generation that experienced early digital fluency, pandemic disruption during critical developmental years, and parenting styles steeped in mindfulness and wellbeing, all of which shape their worldview, expectations and economic behaviours.

If brands want to understand Gen Alpha, they’ll need to stop projecting old narratives onto a new audience. That means moving beyond stereotypes and recognising the distinct experiences and preferences that will shape markets for decades. Strategies grounded in data, and shaped by the realities of this generation, will be key to earning their attention, trust and loyalty.

ㅤ

ㅤ

Many organisations still treat vulnerable customers as a minority, yet vulnerability now affects a substantial and growing share of the customer base of up to 60% according to YouGov, 2025. When communication fails these customers, trust quickly erodes and the financial impact follows by missed payments, abandoned journeys, higher service costs and preventable churn, alongside wasted internal effort spent on communication that simply doesn’t work.

Poor communication quickly becomes a material financial risk, especially when acquisition is so costly:

“In many regulated sectors, acquiring a new customer can cost hundreds of pounds once marketing, incentives and onboarding are factored in” – DMA, 2024

This is why understanding hidden vulnerability is the key to unlocking ROI from every customer interaction.

ㅤ

Want to understand where this cost is hiding in your own customer journeys?

Our report, The Retention Risk of Hidden Vulnerability, reveals how behavioural signals expose risk long before complaints or churn, and how smarter communication protects ROI.

ㅤ

ㅤ

The Immediate Cost of Poor Communication

The financial impact of overlooking vulnerable customers shows up faster than many organisations realise. Communications that are unclear, poorly timed or too complex actively create cost rather than spreading the message that’s intended.

When customers cannot understand or act on messages because of a hidden vulnerability, the result is disengagement. Missed payments, incomplete applications, stalled self-service journeys, the list goes on. In many organisations, each of these failures are often designed to trigger follow-up activity, but by the time you’ve gotten through to a customer, what should have been a single, efficient interaction becomes a costly chain of recovery activity.

These costs scale rapidly. Messages that fail for even a small percentage of customers are multiplied across thousands of accounts and hundreds of journeys each year. Budget is spent producing and distributing communications that deliver little or no return, while operational teams absorb the downstream impact.

At the same time, trust is quietly eroded. Customers who feel confused or overwhelmed disengage, ignore future communications or begin to perceive the organisation as difficult to deal with. This loss of confidence increases the likelihood of the biggest cost of them all, churn, turning communication failure into a direct revenue problem.

ㅤ

Churn Turns Communication Failure into Waste

Churn is where the true cost becomes unavoidable. In many regulated sectors, acquiring a new customer can cost hundreds of pounds once marketing, incentives and onboarding are factored in (DMA, 2024). When customers leave due to preventable communication failures, those acquisition costs are an immediate waste.

This is particularly damaging because the signals of churn are often hard to spot until it is too late. Customers do not always complain, instead they simply stop engaging and move to providers who feel clearer and less demanding. Replacing them requires fresh spend, while competitors benefit from customers you have already invested in acquiring and servicing.

Retention, by contrast, has significantly higher ROI. When organisations lose customers due to confusion rather than competition, margins erode unnecessarily. The business ends up spending more to stand still, rather than improving outcomes for customers it already has.

ㅤ

Operational and Regulatory Costs Compound the Problem

Beyond churn, overlooked vulnerability drives sustained operational inefficiency. Contact centres see higher volumes of avoidable calls. Digital journeys generate repeated failures. Teams spend time correcting misunderstandings rather than adding value.

There is also increasing regulatory scrutiny. Regulators are placing greater emphasis on whether communications are designed in a way that customers, including those in vulnerable circumstances, can understand and act upon. Poorly designed communications that foreseeably disadvantage customers can lead to investigations, remediation programmes and fines, all of which carry significant cost and disruption.

The combined impact is clear: wasted communication spend, higher operational costs, lost revenue and increased regulatory risk, all stemming from messages that fail to work for customers when they are least able to cope.

ㅤ

How Businesses Can Reduce Waste and Protect ROI

Reducing this waste does not require entirely new channels or wholesale transformation. It just requires a shift in how organisations design and evaluate communication effectiveness.

Practical, market-ready actions include:

- Identifying vulnerability through behaviour and engagement patterns, rather than waiting for customers to self-declare.

- Simplifying customer journeys end-to-end, removing unnecessary steps and cognitive load.

- Using data to create a coherent, joined-up view of the customer, preventing contradictory or poorly timed messages.

- Adapting communications dynamically, responding to changes in engagement and circumstance as they occur.

When communications are clearer, more supportive and easier to act on, engagement increases, avoidable additional contact falls and overall retention improves as a result. Addressing vulnerability therefore delivers measurable financial benefit as well as better customer outcomes.

ㅤ

The Retention Risk of Hidden Vulnerability: Read the Report

Overlooking vulnerable customers is a costly business failure. Misaligned communications waste budget, increase operational strain and accelerate churn at a time when acquisition costs continue to rise.

Our full report, The Retention Risk of Hidden Vulnerability, explores how smart communication builds loyalty with vulnerable customers and outlines practical steps organisations can take to protect both customer trust and ROI.

ㅤ

FAQs

ㅤ

Why does overlooking vulnerable customers waste money?

When customers cannot understand or act on communications, organisations incur avoidable costs through missed payments, abandoned journeys, increased contact centre demand and higher churn, turning communication spend into wasted budget.

Who counts as a vulnerable customer?

Anyone whose circumstances reduce their ability to engage with communications, including financial pressure, emotional stress, health issues, digital barriers or situational life events. Vulnerability is often temporary or fluid, changing from week to week or month to month, and affects many more customers than organisations realise.

How does poor communication increase churn?

Confusing and overwhelming communications erode trust. Customers disengage, ignore future messages and eventually switch providers, often without complaint, driving expensive and preventable churn.

What is the regulatory risk of ignoring vulnerable customers?

Regulators increasingly expect communications to be clear, accessible and supportive. Failures that disadvantage vulnerable customers can lead to investigations, remediation programmes, fines and reputational damage.

How can organisations improve ROI by addressing vulnerability?

By simplifying communications, monitoring engagement signals and adapting messages in real time. This reduces avoidable contact, improves retention and ensures communication budgets deliver measurable returns.

ㅤ

ㅤ

At MBA Group, we’re proud to announce that we have been re-awarded the JICMAIL Platinum Award for 2026, reaffirming our position as one of the UK’s leading organisations in data-driven direct mail.

JICMAIL Platinum is the highest level of accreditation awarded by JICMAIL, the industry’s trusted audience measurement currency for mail. They recognise organisations that have fully embedded JICMAIL data into the way they plan, measure and evaluate mail campaigns, treating data rooted in accuracy as a core part of how they operate.

Being named one of just 28 Platinum Partners for another year is a significant achievement for the group. It reflects the expertise across our teams and our continued commitment to using evidence and real-world behaviour to shape effective mail strategies for our clients.

Behind every accreditation like this is a huge amount of work. From ongoing training and knowledge-sharing to consistently applying data-led thinking across campaigns and processes, this award is a testament to the dedication and capability of our people. It recognises access to data in action, measured by how confidently and consistently it’s applied to drive better outcomes.

ㅤ

The Value Behind the Accreditation

In a crowded communications industry, direct mail continues to play a vital role when it’s planned and measured properly. JICMAIL provides robust insight into how mail is received, read and acted upon, enabling our business to make smarter and more informed decisions, with clearer measurement and greater accountability.

For our clients, Platinum accreditation means:

- Campaigns are informed by detailed realistic audience behaviour

- Greater confidence in performance measurement and evaluation

- Data-led recommendations from our team that strengthen mail’s role within the wider channel mix

ㅤ

Looking ahead

We’re proud to continue our partnership with JICMAIL year on year and remain focused on pushing boundaries, sharing best practice and unlocking the full potential of data-led mail campaigns.

This re-accreditation is both a milestone and a motivator, reinforcing our commitment to insight, transparency and delivering measurable value through every campaign we support.

ㅤ

Read the full JICMAIL announcement here.

ㅤ

ㅤ

ㅤ

This year, our Christmas campaign, Connected at Christmas, celebrates the connections that matter most, both within our group and with the people we serve through our communication solutions.

Our Christmas card brings the concept to life through illustrations by Shoreditch Sketcher Phil Dean, Founder of our creative agency, Studio Certain. Inspired by sketches of our UK sites in Tottenham, Central London and Warrington, and enriched with subtle festive touches and real imagery of our people, the design reflects the spirit of togetherness at MBA Group.

As a family-run business built on relationships, connection is at the heart of everything we do. The relationships we build with our colleagues, clients, their customers and our partners shape how we work, how we grow and the value we create together.

From all of us at MBA, we wish you a very Merry Christmas and a wonderful festive season spent with the people you care about most.

ㅤ

If your organisation is preparing for the next chapter in communication, we’re here to help you make it happen.

ㅤ

ㅤ

At MBA, our strength has always come from the relationships we’ve built and maintained with our clients from over 40 years of transforming communications.

As we continue to grow rapidly, welcoming new clients while supporting long-standing ones, we’re constantly working to optimise a faster, more efficient onboarding experience. Migrations must be seamless, communication must remain accurate, compliant, and secure, and expectations for speed have never been higher.

We’ve already invested heavily in streamlining our processes through development work, and while that has delivered strong progress, we’ve always recognised the need for further evolution in areas still reliant on traditional coding. With the intelligence and flexibility of AI, we know we can achieve more, and as a service provider, it’s imperative that we explore those possibilities. So when AWS recommended Devoteam as a partner to help us understand how AI could enhance our onboarding workflow, we seized the opportunity to take our approach further.

Instead of asking Devoteam to solve only the parts we hadn’t yet addressed, we gave them the entire challenge. We wanted a clear, unbiased view of what AI could deliver when applied end-to-end.

ㅤ

Reimagining a Core MBA Process

ㅤ

Onboarding a new client at scale is a detailed, highly specialised piece of work. Traditionally, our expert BA team analyses and transforms thousands of customer communication templates, each one needing to align with brand guidelines, regulatory requirements and the client’s own expectations.

It’s a process that demands care, consistency and deep domain expertise.

By stepping back and examining this workflow through the lens of AI, we identified several opportunities to improve:

- Speeding up onboarding from months to days

- Ensuring greater consistency across thousands of documents

- Freeing our BA team from repetitive manual extraction

- Increasing the time they can spend on design, quality and innovation

- Delivering a noticeably faster, more modern onboarding experience for clients

We saw AI as an opportunity that would empower our analyst teams and in turn, deliver the best customer experience for our clients.

ㅤ

Partnering with Devoteam to Explore What AI Could Deliver

ㅤ

Working with Devoteam, an AWS Premier Partner, we launched a Generative AI-powered Proof of Value (PoV) aimed at showing what an AI-supported onboarding process could look like at MBA.

The PoV focused on analysing PDF templates and transforming them into a structured, highly organised library of reusable components.

Key capabilities developed included:

- Paragraph and element analysis: Recognising headers, footers, signatures and data fields

- Brand capture: Identifying fonts, colours and layouts so branding stays precise

- Image cataloguing: Extracting imagery, placements and dimensions

- Variable indexing: Detecting placeholders and embedded variables

- Master template detection: Understanding the core structure behind diverse document sets

These were areas that would traditionally take our team weeks of manual scrutiny, but AI was proving to accomplish many of them in minutes.

ㅤ

A Fast, Collaborative Delivery Approach

ㅤ

Devoteam worked closely with our BA team using their ADAPT framework, progressing through tight, focused sprints:

- Discovery & scoping: Clarifying objectives and what success would look like

- Rapid prototyping: Building and refining GenAI models based on real MBA data

- Testing & validation: Comparing the AI’s output with results our BA team produced previously

- Roadmapping: Outlining how MBA could scale the solution into production

This collaboration kept the work grounded in reality. We weren’t relying on theoretical AI promises, we were measuring real, tangible improvements against an already complex process.

ㅤ

The Impact: Faster, Smarter and More Accurate

ㅤ

The impact was significant. Work that once took months could now be completed in a matter of hours, accuracy improved with far fewer manual errors, and our BA team were able to redirect their time toward more strategic, value-driven work such as auditing, innovation and quality assurance.

For us, it validated a belief we had going into the project: the future of onboarding at MBA isn’t AI or code, it’s the intelligent combination of both.

ㅤ

Where We Go from Here

ㅤ

The success of testing how AI efficiency can improve our onboarding processes has unlocked a new phase for MBA.

We’re now shaping these learnings into a roadmap, where we’ll introduce asynchronous parallel processing to increase speed even further, integrate AI outputs directly into our wider document management ecosystem, and blend Devoteam’s AI models with our own codebase to build a powerful, efficient hybrid solution.

And while the PoV delivered strong results, we fully expect that we’ll engage with Devoteam again as we continue to expand our AI capability. The collaboration has already shown what’s possible, and we know there is more value to unlock.

By embracing the best of both AI and engineering, we’re continuing to move forward alongside technology developments at MBA, delivering our promise of simply powerful communication, and redefining what enterprise-level onboarding can look like.

ㅤ

“At MBA Group, we’re proud to be using Artificial Intelligence to drive efficiency, innovation, and value for our people and clients. Partnering with Devoteam on our Generative AI initiative has been a key step in that journey, helping us streamline client onboarding, accelerate delivery, and empower our teams to focus on higher-value work. This Proof of Value demonstrates our commitment to using AI that delivers real benefits and strengthens MBA’s position as a leader in intelligent, transformative customer communications.”

- Phil Coleman, Head of Products & Projects, MBA Group

ㅤ

Our Evolution Timeline

ㅤ

ㅤ

For over 40 years, MBA has been at the heart of how organisations communicate, evolving from traditional print roots into a leader in secure, data-driven, omni-channel communication.

This timeline, launched at our 40th celebration earlier this year, highlights the milestones, innovations, and moments that shaped MBA into the powerhouse it is today. It showcases how the business has consistently adapted to new technologies, new expectations, and new ways of connecting, always with our people at the heart.

As we wrap up the year and look towards 2026 and beyond, the story continues. Our channels are expanding, our partnerships are growing, and our investment in technology and AI is accelerating. The same spirit of innovation that defined our past is driving our future, helping us build smarter, more seamless, and more personalised ways for organisations to communicate in the years ahead.

ㅤ

If your organisation is preparing for the next chapter in communication, we’re here to help you make it happen.

ㅤ

When MBA Group launched its apprenticeship programme in December 2023, we set out to tackle the industry’s skills gap head-on. Fast forward to 2025, and our apprentices are already driving real change, bringing fresh energy to teams and delivering on major projects.

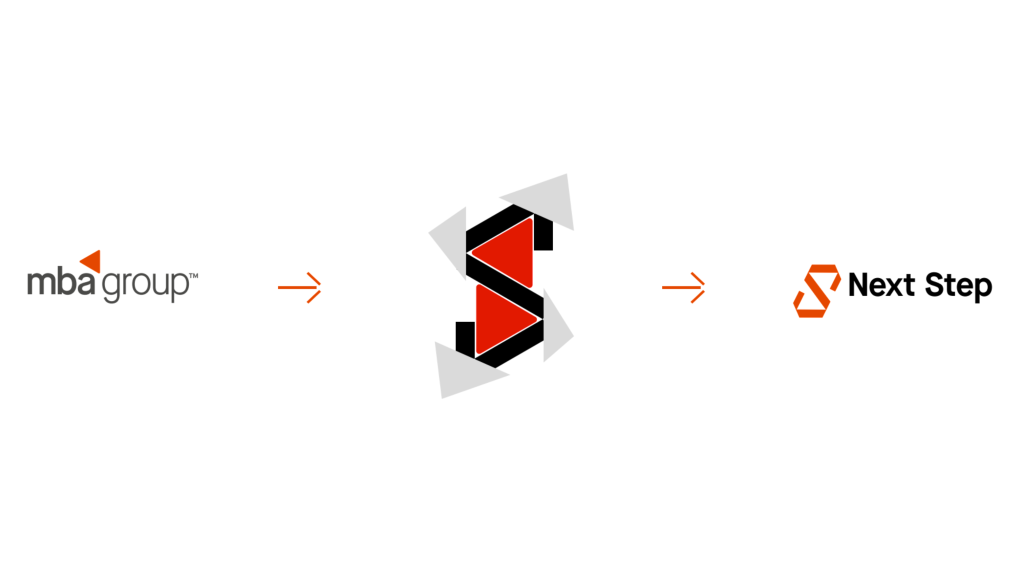

But here’s where it gets exciting: one of our own apprentices, Hannah Hall, spotted an opportunity through a university assignment. Her project? A bold new identity for the apprenticeship programme itself.

The work was so impressive, packed with insight, research, and standout design, that we didn’t just grade it. We brought it to life. Next Step is now our official apprenticeship brand, rolling out across welcome brochures, recruitment materials, and beyond.

This is how a university assignment became the face of MBA’s talent strategy and proof that great ideas can come from anywhere.

ㅤ

The Opportunity

ㅤ

Our apprenticeship initiative was built to do more than fill skills gaps. It creates real career pathways into print, tech and creative services.

Research by our HR Advisor revealed a key insight: a dedicated, youth-friendly brand could transform how we connect with the next generation. Here’s what it could achieve:

- Attract and inspire 16-25 year olds with a fresh, relevant identity

- Build pride and belonging among current apprentices

- Showcase MBA’s commitment to developing talent

- Bring clarity and consistency to recruitment, onboarding and communication

ㅤ

A Brand Built for Apprentices, by an Apprentice

ㅤ

Hannah brought something invaluable to the project: she’d lived it. As both designer and apprentice, she understood the journey firsthand in a way no external agency could.

The brief was simple but ambitious: create a brand that feels fresh and modern, resonates with young talent, and stays true to MBA. That meant everything from naming and logo design to onboarding packs and social media assets.

But this wasn’t guesswork. Hannah interviewed fellow apprentices, reviewed the current onboarding experience, and studied what’s happening across the apprenticeship landscape. The insights were clear.

Q: What kind of personality should the brand have: fun, professional, supportive, bold?

Apprentice: “I believe that the brand should have a mix of all 4 attributes where appropriate. This means that the company should be something that fosters growth while allowing you to be yourself.”

The result? A brand that feels youthful yet credible, energetic yet grounded. Something apprentices can connect with from day one, designed not just for them, but with them.

ㅤ

Creative Exploration

ㅤ

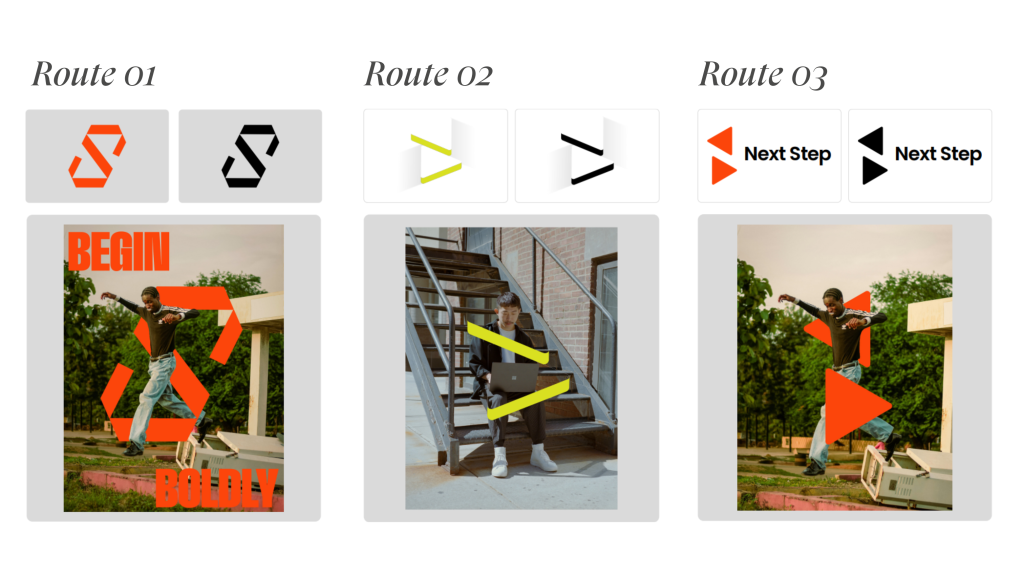

Hannah explored multiple naming and design routes, each expressing progress, confidence and opportunity in different ways. Early options included ‘nxt’, ‘Spark’, and ‘Next Step’.

‘Next Step’ emerged as the clear winner. It felt grounded, accessible and true to MBA’s values while capturing something essential: movement, growth, and that pivotal first step into a meaningful career.

From there, Hannah developed three visual routes before landing on a final direction that balances youthful energy with professional polish.

The chosen direction strikes the perfect balance between MBA’s established brand and a fresh, youth-oriented identity. The logo subtly incorporates the triangular motifs used throughout the MBA brand, blending them with a more modern symbol to represent what it stands for.

“As an apprentice myself, I was able to draw on my own experiences, which gave me a stronger connection to the work and a clearer sense of direction when making creative choices. This sense of connection made the project feel both meaningful and enjoyable. It wasn’t just about creating something that looked good; it was about designing something that spoke directly to people like me. This gave the project an authenticity that I might not have been able to achieve otherwise.” – Hannah Hall

ㅤ

MBA Brings Next Step to Life

ㅤ

MBA’s leadership team saw something special in Hannah’s work. What started as a university project was a brand concept ready to become a real asset.

The decision was made: Next Step would become the official identity for the apprenticeship programme. A rare moment where a student brief transformed into a live brand.

The first real-world deliverable followed quickly: a physical welcome brochure, designed by Hannah using the identity she’d built from the ground up.

Perfect timing, too. When MBA held its next Apprentice Assessment Day to find the next wave of talent, we had the ideal piece to put in their hands.

ㅤ

You can view and read the full brochure here.

ㅤ

This is just the beginning for Next Step, but this project represents something bigger: it’s proof of concept for the entire apprenticeship programme. MBA didn’t just hire Hannah to fill a role. We invested in her potential, gave her real responsibility, and watched her deliver work that’s now shaping how we attract and welcome the next generation of talent.

That’s exactly why we run an apprenticeship programme. To find fresh thinking. To nurture raw talent. To give people the space to grow, contribute, and make their mark from day one.

A huge thank you to our Digital Design Apprentice, Hannah Hall, for showing us what’s possible when you give apprentices the platform they deserve!

ㅤ

ㅤ

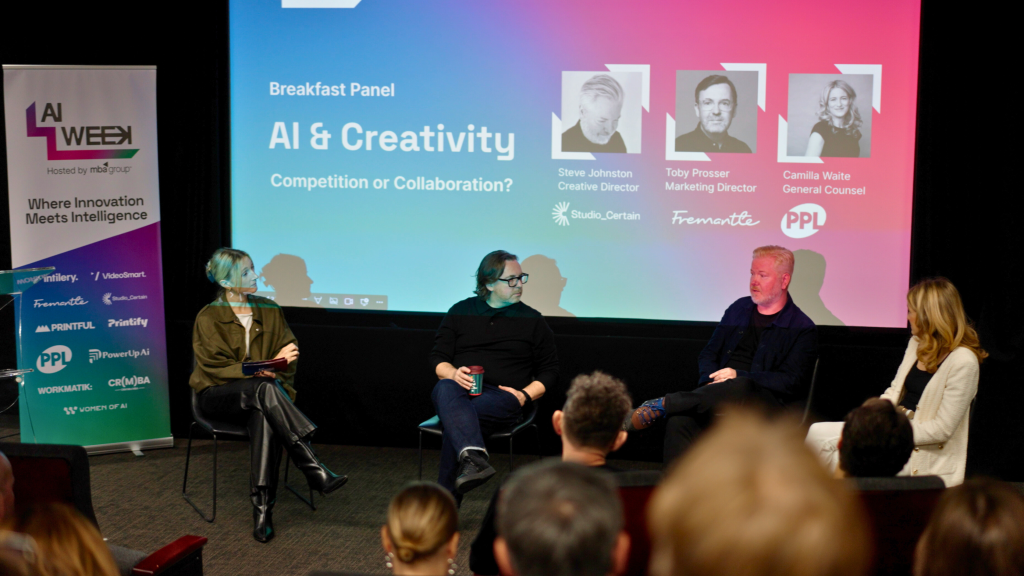

Last week, we opened our doors for MBA’s first-ever AI Week: a packed programme of panel discussions, online sessions and live demonstrations exploring how AI is reshaping the way organisations communicate, create, and connect with customers.

When we first planned AI Week, we wanted it to be a space to unpack the questions, opportunities, and understandable concerns that have surfaced as AI has quickly reshaped the digital world and slipped into the background of so much of our everyday lives. It’s fair to say we achieved that, and more. Each event sparked thoughtful conversations, fresh ideas, and a real sense of momentum around how AI can support smarter, more connected customer experiences.

ㅤ

Four Events. Three Days. One Big Conversation About the Future of Communication.

Event 1: AI & Creativity: Collaboration or Competition?

Hosted by Studio Certain

We opened the week by diving into one of the most debated questions in the creative world: what does generative AI mean for creativity? The conversation covered everything from the risks of misuse to the huge potential for AI to expand what creators can do.

We heard a range of viewpoints, from how PPL are navigating AI’s impact on copyright, licensing, and performer royalties, to Fremantle’s focus on safeguarding originality while still embracing innovation. The session also showcased striking examples of AI-enhanced creative work, including how Studio Certain are using AI to develop complex, brand-attuned visuals that speed up ideation without compromising craft.

“AI is an incredible assistive tool in so many creative endeavours. But what’s really essential is that we have transparency around what creative works have been used in the training of an AI system.” – Camilla Waite, General Counsel, PPL

The discussion closed with the big question: is AI competition or collaboration?

Our panel’s answer: it can feel like both, especially in the early stages, but ultimately, AI becomes a collaborative partner when guided by human imagination. Creativity still starts with people; AI just helps push the boundaries.

“I hope people will have more curiosity, more interest, more excitement about what’s happening in the AI space.” – Toby Prosser, Director of Global Marketing, Fremantle

ㅤ

Event 2: How to Build the Best AI Outcomes Through Inclusive Data Science

Hosted by Women of AI

Day two shifted the focus from creativity to people. Cerestrial, an inclusive and sustainable growth leader, led an engaging session on how inclusivity strengthens AI outcomes and why diverse teams are crucial to responsible innovation.

The audience took part in a live AI talent inclusivity audit, which sparked honest discussion about where bias shows up, who gets excluded, and what meaningful representation really looks like in practice.

A standout reminder from the session was this: curiosity drives better AI outcomes than technical skill alone. You don’t need to be a developer to shape how AI functions, you just need the willingness to question, explore, and challenge assumptions.

The panel also highlighted key issues with today’s AI systems: they’re often trained on narrow datasets that don’t reflect the people meant to use them. As our hosts pointed out, diversity isn’t just ‘a good thing to do’, it leads to better business growth. Broader perspectives lead to better insights, more relevant experiences, and can even reduce development time dramatically.

This session encouraged us to look beyond the technology itself and pay closer attention to the people behind it, a perspective that will be influencing MBA’s own AI roadmap going forward.

ㅤ

Event 3: Not Just a Transaction: Using AI to Drive Lasting Loyalty

Hosted by Intilery

Our online session with Intilery brought the conversation back to fundamentals: AI isn’t a magic fix for customer strategy, and it won’t transform customer behaviour on its own.

“I think it’s really important to have that conversation around how AI and customer loyalty comes together to deliver business objectives and to deliver on customer expectations” – Gianfranco Cuzziol, CRM Specialist

A key message from the session was that success with AI in CRM starts with getting the basics right: knowing your customers, understanding their needs, and building experiences that earn trust. Too many organisations jump straight into AI expecting it to ‘do the work’, without the groundwork that makes those tools effective.

We also explored the reality that you don’t need to wait for perfection to start. Small, low-risk experiments can drive valuable early learning, as long as teams understand how to manage risk responsibly.

The panel reinforced that AI should never be used for the sake of it. Its value lies in making things smoother, faster, and more personalised for real people. It’s about enhancing customer experience whilst keeping the human empathy at the heart of strong relationships.

Ultimately, the session reminded us that loyalty isn’t built through technology alone. It comes from consistent experiences that respect the customer, and AI is most powerful when it strengthens, not shortcuts, that connection.

Missed this webinar? You can watch the full session here.

ㅤ

Event 4: Beyond the Algorithm: How Brands Maintain Authenticity in the AI Era

Hosted by VideoSmart

We closed the week with a vibrant discussion on authenticity, and what it means at a time when AI is part of nearly every creative and marketing process.

The panel tackled one of the biggest questions brands have right now: how do you keep your message genuine when AI is everywhere? Rather than leaning into the fear or controversy, the discussion encouraged experimentation and openness. As one of our speakers said, “the first pancake is never perfect” but every test teaches you something valuable.

“We haven’t yet unlocked the deeper level of what AI can do, and I think how we do that is by going out and using it to see what we can get from it.” – David Hooker, Head of Brand, Printful

The takeaway was clear: customers care far less about whether something was made with AI, and far more about whether it feels honest, relevant, and emotionally meaningful. Authenticity comes from staying true to your brand values and keeping your audience front and centre.

AI is levelling the creative playing field. You no longer need specialist skills to express an idea visually or conceptually. But even as AI speeds up execution, one principle endures: quality is still quality, regardless of the tools used to make it.

“Don’t be all the gear and no idea. It’s fantastic technology that will give us speed and scale, but take time to understand who you are and what you stand for.” – Scott Stockwell, Founder, Workmatik

ㅤ

Shaping the Future of AI at MBA

AI Week wasn’t just a chance for us to showcase ideas, it helped shape our own direction.

“There’s so much noise and confusion about how AI should be used. When you come together in one space and hear from people about how they’re using it effectively, it gives you that confidence to go away and start doing it.” – Leilah Aintaoui, Digital Growth Director, MBA Group

Across every communication channel, AI is opening new ways for us to streamline processes, enhance personalisation, and support more responsive customer journeys. But the message that resonated across all four events was that AI must be used responsibly, securely, and with people at the core.

As we look ahead, MBA will continue investing in technologies that empower both our clients and our teams. That means:

- Developing responsible, secure AI capabilities

- Enhancing automation across the customer communication lifecycle

- Supporting clients as they adopt AI confidently and compliantly

AI Week proved that the future isn’t about choosing between people and technology. It’s about combining the two to create experiences that are smarter, safer, and more meaningful.

We can’t wait to help shape that future for our clients!

ㅤ

This is just the beginning

Unlock our toolkit for actionable AI solutions:

Download Your AI Blueprint: From Hype to Impact

Take the Quiz: Meet Your AI Match

ㅤ

ㅤ

Artificial intelligence is quickly reshaping communications, in how we create, engage, and build trust with audiences.

This November, MBA Group is bringing together the minds leading this transformation for AI Week 2025, a curated series of events exploring the intersection of intelligence and innovation.

Taking place November 10-14 at Hend House, Central London, AI Week offers a rare opportunity to hear from pioneering thinkers and leading brands across creativity, customer engagement, and brand authenticity. Whether you’re navigating AI implementation or questioning its role in your industry, these conversations will challenge assumptions and spark new possibilities.

ㅤ

What’s on?

ㅤ

AI & Creativity: Collaboration or Competition?

Hosted by Studio Certain

Central London

Tuesday 11th November 2025 | 9am – 11am

The creative industries are at a crossroads. As AI tools become increasingly sophisticated, the fundamental questions around originality, authorship, and what makes work truly creative are being rewritten in real time.

This breakfast session brings together Steve Johnston from Studio Certain, Toby Prosser from Fremantle, and Camilla Waite from PPL to explore how AI is transforming culture, from design to entertainment, and what it means for the future of creative work.

ㅤ

Not Just a Transaction: Using AI to Drive Lasting Loyalty

Hosted by Intilery

Online Webinar

Wednesday 12th November 2025 | 3pm – 4pm

Customer engagement is evolving beyond campaigns and touchpoints. This online session examines how artificial intelligence can transform generic interactions into genuine relationships built on trust and personalisation.

Presented by Pooja Jain from PowerUp AI, Tom Anderson from Intilery, Sami Aintaoui from MBA Group, and Gianfranco Cuzziol, the discussion will move beyond surface-level automation to explore how AI can strengthen customer connections in meaningful ways.

“AI enables personalisation at scale, but finding the balance between understanding customer intent and respecting boundaries? That’s still our job as humans,”

says Pooja Jain, highlighting the essential human judgment that must guide AI implementation.

Gianfranco Cuzziol takes this further:

“The line between personalisation and manipulation has never been thinner. AI lets us predict what customers will do next, but predictions aren’t the same as relationships. The real opportunity is to use AI not to speak more, but to listen better. To move from segmentation to understanding, from journeys to meaning.”

The session challenges a fundamental assumption: that loyalty built by algorithms alone can ever truly be loyalty.

As Cuzziol notes, “Loyalty built by algorithms isn’t loyalty at all, it’s a habit.”

ㅤ

Beyond the Algorithm: How Brands Maintain Authenticity in the AI Era

Hosted by VideoSmart

Thursday 13th November 2025 | 9am – 11am

Central London

When every brand has access to the same AI tools, what becomes the differentiator? This breakfast panel tackles perhaps the most critical question facing marketers today: how to maintain authenticity, trust, and distinctiveness in an AI-driven world.

Mike S. from VideoSmart, David Hooker from Printful, Alex Waite from LCP, and Scott Stockwell from Workmatik will explore how AI is transforming storytelling, production, and personalisation, and what it takes to stay genuinely connected to audiences.

Scott Stockwell emphasises the foundation:

“Trust is fundamental to building relationships and authenticity is fundamental in building trust. With AI offering unprecedented speed and scale, it’s imperative brands stay true to themselves to build that trust.”

David Hooker reflects on the shifting landscape:

“There’s no longer any excuse for creating boring, difficult to consume content. Every day AI is reducing the skills barrier for anyone who wants to make wow moments. This is in equal parts inspiring, exciting, and terrifying for anyone working in marketing or any creative field.”

ㅤ

Join the Conversation

The questions being asked at AI Week 2025 are the same ones that are keeping marketers, creatives, and business leaders up at night. How do we use AI without losing what makes us human? How do we scale without sacrificing authenticity? How do we innovate without abandoning the principles that built trust in the first place?

These conversations will challenge how you think about AI’s role in your work. They’ll introduce you to peers navigating the same questions. And they’ll equip you with frameworks, insights, and connections to move forward with confidence.

Ready to be part of the conversation? Register for AI Week 2025 today and discover where innovation meets intelligence.